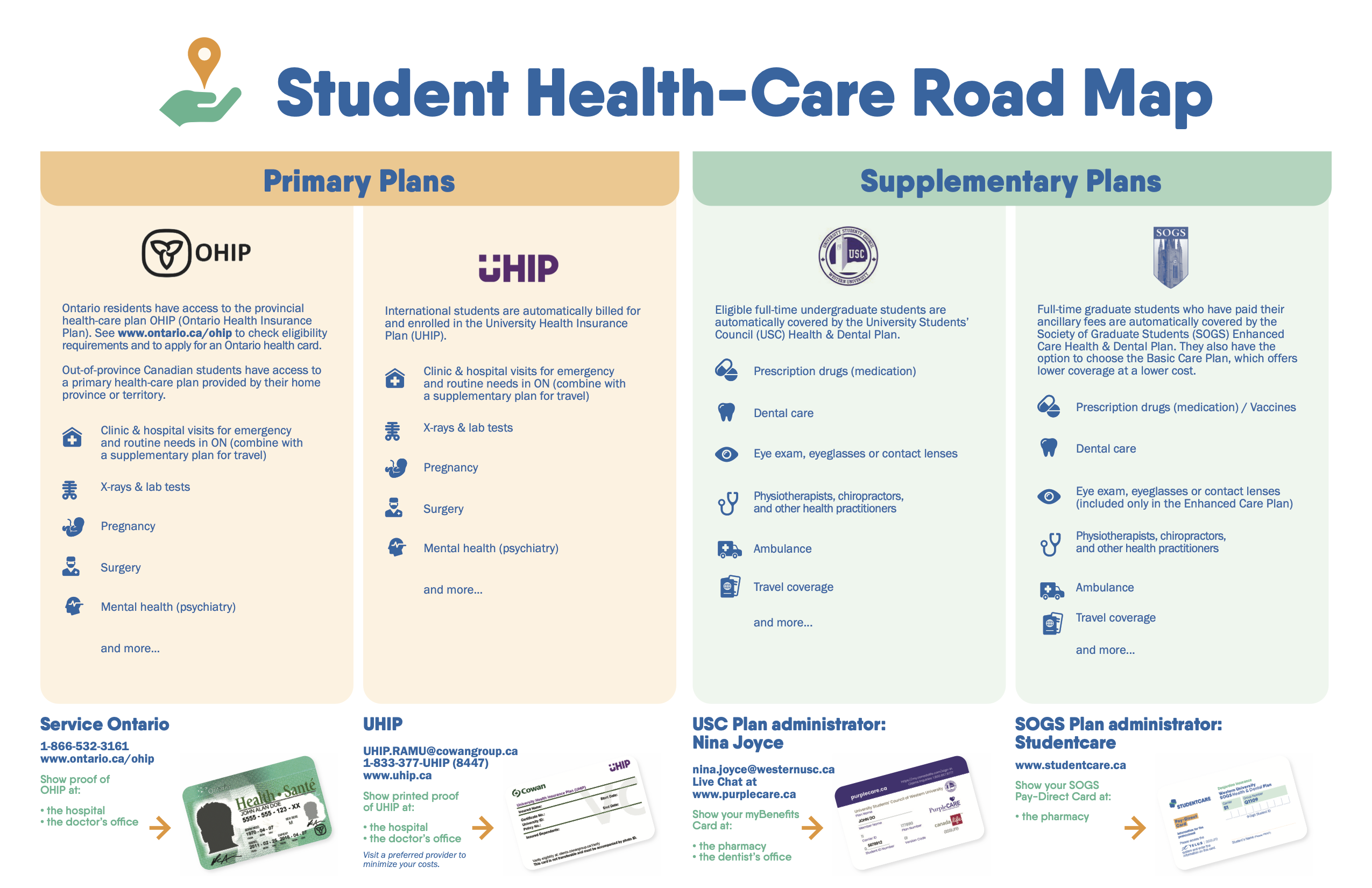

The SOGS health plan is insured by Desjardins (#Q1109) and administered by Studentcare.

The SOGS health plan is insured by Desjardins (#Q1109) and administered by Studentcare.

Have questions about how to use our health plan? See Studentcare’s FAQ.

Have questions about recently submitted health claims or change of coverage questions (i.e, opt-in/opt-out)? Contact our insurance broker, STUDENTCARE. Learn how to contact Studentcare HERE.

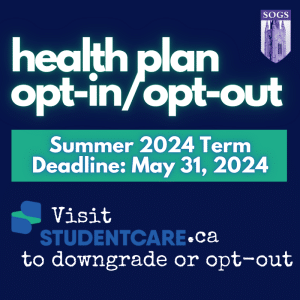

SUMMER TERM CHANGE OF COVERAGE PERIOD: May 1 – 31, 2024.

Have feedback about the health plan’s coverage? Contact our VP Student Services (services@sogs.ca).

WHO GETS A HEALTH PLAN?

- Full-time graduate students who are SOGS members are automatically billed for, enrolled in, and covered by the SOGS Health & Dental Plan. If you are uncertain about whether you have been charged this fee, check your tuition bill.

- Part-time graduate students, Non-Residential graduate students (Professional Education), and Leave of Absence graduate students are NOT billed for this benefit due to their enrolment status and therefore, have the option of purchasing the heath & dental plan directly through Studentcare.

Learn more about your plan here:

For a detailed breakdown of what the plan covers, please come to the SOGS office (Middlesex College, room 8) or visit Studentcare.ca. Use your Pay Direct card to fill your prescriptions at most Canadian pharmacies. International students: please contact Janis Kramer (jkrame4@uwo.ca), HR Coordinator, UHIP, if you require information about the University Health Insurance Plan: (519)-661-2111 Ext. 85536. Postdoctoral Scholars at Western, international and domestic, fellows and associates, and graduates of any institution can opt into the Western Alumni Health Plan. Exchange and Visiting students at Western University are NOT eligible for the SOGS Health Plan. *DISCLAIMER: International students can NOT submit claims to Desjardins for regularly covered health treatments received abroad or in their home countries. Desjardins will NOT reimburse these claims. Emergency medical coverage is only to be used outside of Canada and the home countries of international students. If you are a full-time student automatically enrolled in and billed for the SOGS health plan and/or have family members (partner and/or children under 21 years of age or 25 if a student) you wish to opt-in, you must: FULL-TIME STUDENTS! Full-time students who are already covered under another equivalent insurance plan (e.g. your parents’, spouse or employer’s). Once you opt-out, you will receive a refund for the premium on your tuition fee bill. Please be advised that a credit for the premium will appear on your tuition fee bill in mid-October. Opt-Out Schedule: Click the above link and follow the instructions provided on the Studentcare website. *Note: Please be advised that ONLY grad students who already have an equivalent extended health and dental insurance policy can opt-out. UHIP and OHIP (or any other provincial insurance policy) does NOT qualify as an “equivalent health plan”. For your own reference, the Studentcare Group Number for your Health & Dental coverage is Q1109, and the insurer is Desjardins (carrier #51). Your personal account number is your student card number. All claim forms can be found here. The fastest way to submit a claim is through the mobile app (look for the Omni by Desjardins app on the App Store or Google Play,) but you can also mail them to Desjardins (the insurance provider) yourself. For detailed information on how to submit a claim, see the Studentcare website. *DISCLAIMER: International students (including US students) who are not permanent Canadian residents may not use their travel health coverage when traveling to their country of origin. If you would like to see your CLAIMS HISTORY with Desjardins, please create a profile with the insurance company. Once you have completed your registration, you can login to the Desjardins site here. For example, you may want to submit additional expenses not covered by the insurance company (because you have already maxed out the allotted coverage for the year) to the PSAC Local 610 Extended Health Plan for TAs. If you you submitted a claim and have a question or concern about that claim, call Studentcare Member Services Centre: 1 866 358-4435, Mon. – Fri. from 9 am to 5 pm. For Travel, the Group Number is 97180, and the insurer is Blue Cross. Your personal account number is your student card number. *DISCLAIMER: International students (including US students) who are not permanent Canadian residents may not use their travel health coverage when traveling to their country of origin. To make the most of your plan, take advantage of Studentcare’s Network where you can receive discounts on your medical and dental expenses with approved providers. Studentcare also offers a Rexall Exclusive Savings Card (10% off prescription drugs, and 20% off regularly price items). If you are a Teaching Assistant (TA) and a member in good standing with PSAC 610, you will be able to apply for the Extended Health Plan (EHP), which you can use to increase your overall health care coverage. We recommended that you apply for your SOGS coverage first, and then submit your claims to PSAC 610. To prove that you have maxed out your SOGS coverage, visit Desjardins and log in to your account. Under, “I want to”, click on “Consult my transaction history”. Click on “Details” next to the transaction history you wish to print the proof of claim for. Print this document and submit it to PSAC 610. *Claims Disclaimer: 2021-22 POLICY YEAR PLEASE NOTE THAT ALL CLAIMS ARE DUE WITHIN 90 DAYS OF THE POLICY YEAR. (e.g. if you are submitting claims incurred on September 1, 2021 through August 31, 2022 and onward, your claims must be received by Desjardins Insurance by November 30, 2022. What does the SOGS Health & Dental plan cover?

Who Can Opt-in to the SOGS plan?

How to Opt-in

Full-time Students: How to opt-in your family

Part-time students, Non-Residential students, and Leave of Absence students (plus family members):

Who can Opt-out?

How to Opt-out

OPT-OUT HERE.

How to Submit a Claim

To register for Direct Deposit, see here.

To check the status of your Claim, see here.

Claims History

Travel coverage

If you use any of your travel benefits, you must call CanAssistance (Canada and United States: 1-866-601-2583 *toll-free*/ Other Countries: 0-204-775-2583 *collect*) immediately to find out how and when to submit your claims. See the Travel Health Passport and detailed explanation of coverage for more information.

How to get a Travel Letter for Visa Applications

How to get a Travel Letter for Visa Applications

Make the most out of your coverage: Studentcare Network

Additional coverage for Teaching Assistants

PSAC 610 Extended Health Plan (EHP)